File a return online

This topic explains how to submit a Return online. If you're going to submit on paper, see File a Return by paper.

Before you begin

- Your practice must be registered for Online filing with HMRC.

- Make sure you've entered your HMRC User ID and password. From the Return menu, choose Online Filing > Online Filing Credentials. You will need the Administrator password to enter or amend the credentials.

To file online:

-

Open the copy of a return or final return.

- In the Tasks pane click Start submission process. The SubmissionWizard appears.

-

Choose File Online.

Note: If the return has failed validations, File on Paper will be the only option available.

- Click Next. The Send Return to Client page appears.

- If you haven't already sent the return to the client for them to sign, you can either print the return or save as PDF and send to them via email for them to review.

- Enter the date you sent the return to the client.

-

Click Next.

Note: At this stage, you will have sent the return to the client and will be waiting for them to review and sign the return. Partnership Tax expects you to close this wizard and continue with it when you receive approval from your client.

- Click Close.

-

Open the copy of a return or final return.

-

Click Continue submission process. The Submission wizard appears.

Tip: Make sure you're on the Client Approval page. - Select Yes and enter the date of approval.

- Click Next. The Ready to File page appears.

- Click Close.

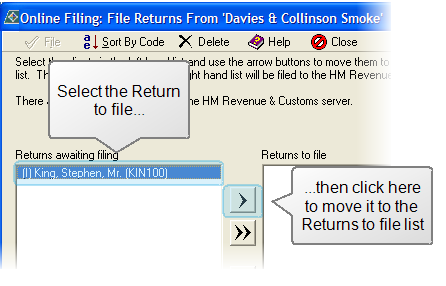

- Choose Return > Online Filing > File Return. The Online Filing window appears.

- Select the return to file then click the arrow button to move the return to the Returns to file list.

Note: If there are returns available to file from more than one year you'll be able to select and process the earlier years before moving on to the later years.

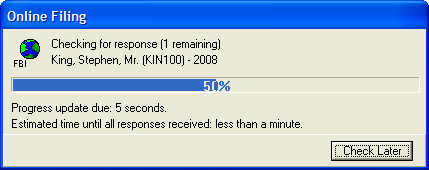

- Click File. Progress bars appear showing the submission status.

- Make sure you have the copy of the finalised return selected in the drop-down list above the Tasks pane.

-

Click Continue submission process in the Tasks pane. The Submission wizard appears.

Tip: Make sure you're on the HMRC Response page.

- Enter the date of the response.

- Click Next. The status of the return changes to submitted.

- Click Close.